Shopping can be a thrilling experience, especially when you have the right tools in your pocket. Enter the TJ Maxx Card—a game-changer for bargain hunters and savvy shoppers alike. Whether you're hunting for designer outfits at unbeatable prices or looking to upgrade your home essentials, this card is designed to make your shopping adventures more rewarding. So, what exactly is the TJ Maxx Card, and why should you consider it? Let's dive in and find out!

Let's face it—shopping is an art, and having the right financial tools can make all the difference. The TJ Maxx Card isn't just a piece of plastic; it's a gateway to exclusive deals, cashback offers, and a smoother shopping experience. If you're someone who loves to shop smart, this card could be your new best friend. From everyday essentials to seasonal sales, this card has got your back.

But before we get too excited, let's take a closer look at what makes the TJ Maxx Card stand out in the crowded world of retail credit cards. Whether you're a first-time cardholder or a seasoned shopper, this guide will help you understand how this card works, its benefits, and how it can fit into your financial strategy. So, buckle up, because we're about to embark on a shopping journey like no other!

Read also:Salem Evening News Death Notices Your Trusted Source For Local Remembrance

What is the TJ Maxx Card?

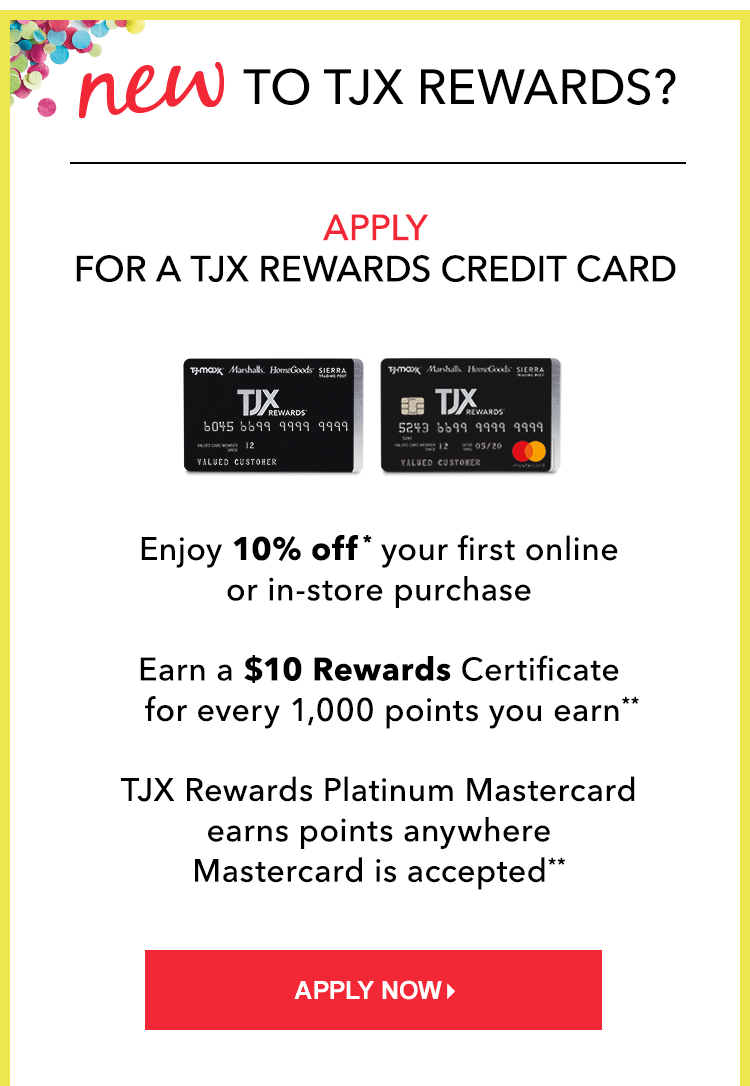

The TJ Maxx Card is more than just a credit card—it's your ticket to exclusive savings and rewards at your favorite TJ Maxx stores. Issued by Synchrony Bank, this card is designed to enhance your shopping experience by offering perks such as special discounts, cashback on purchases, and flexible payment options. Whether you're shopping for clothes, home decor, or accessories, the TJ Maxx Card ensures you get the most bang for your buck.

One of the standout features of the TJ Maxx Card is its simplicity. Unlike other retail cards that come with a laundry list of terms and conditions, this card keeps things straightforward. You can use it at any TJ Maxx location, and it's accepted online as well. Plus, with the added bonus of cashback offers and deferred interest on certain purchases, it's a no-brainer for anyone looking to maximize their shopping potential.

But here's the kicker—this card isn't just for TJ Maxx enthusiasts. It also works at Marshalls and HomeGoods, giving you even more options to explore. So, whether you're hunting for a new outfit or looking to revamp your living room, the TJ Maxx Card has you covered.

Key Features of the TJ Maxx Card

Now that we've covered the basics, let's zoom in on some of the key features that make the TJ Maxx Card a must-have for savvy shoppers:

- Cashback Offers: Earn cashback on eligible purchases, giving you a little extra to spend on your next shopping trip.

- Deferred Interest: Enjoy deferred interest on select purchases, allowing you to pay off your balance over time without worrying about interest charges.

- Exclusive Discounts: Access special discounts and promotions that aren't available to regular shoppers.

- No Annual Fee: The TJ Maxx Card doesn't charge an annual fee, making it a budget-friendly option for everyday use.

These features are designed to make your shopping experience as seamless and rewarding as possible. Whether you're a fan of TJ Maxx's famous "treasure hunt" or simply love a good bargain, this card offers something for everyone.

How Does the TJ Maxx Card Work?

Using the TJ Maxx Card is as simple as swiping—or tapping—at the checkout counter. Once you've applied and been approved for the card, you can start using it immediately at any TJ Maxx, Marshalls, or HomeGoods store. But here's the cool part—you don't have to carry a physical card if you don't want to. The TJ Maxx Card can be added to your digital wallet, making it even more convenient to use.

Read also:What Happened To Belle Delphine The Untold Story Behind The Controversy

When you make a purchase with the card, you'll automatically qualify for any ongoing promotions or cashback offers. Plus, you'll receive statements detailing your spending habits, helping you keep track of your expenses and manage your budget more effectively.

Steps to Apply for the TJ Maxx Card

Applying for the TJ Maxx Card is a breeze. Here's a quick rundown of the steps:

- Visit the official TJ Maxx website or head to your nearest store.

- Fill out the application form, providing basic information such as your name, address, and income details.

- Submit your application and wait for approval. The process is usually quick, and you'll receive an instant decision in most cases.

Once you're approved, you'll receive your card in the mail—or you can opt for a digital version if you prefer. It's that simple!

Benefits of the TJ Maxx Card

The TJ Maxx Card isn't just about convenience—it's packed with benefits that make it a worthwhile addition to your wallet. Here's a closer look at what you can expect:

Cashback Rewards

One of the most appealing features of the TJ Maxx Card is its cashback program. By using the card, you can earn cashback on eligible purchases, which can be redeemed for future shopping trips. This means you're not just spending money—you're earning it back!

Exclusive Discounts

Holding a TJ Maxx Card gives you access to exclusive discounts and promotions that aren't available to regular shoppers. From early access to sales to special event pricing, the card ensures you're always in the know about the best deals.

Deferred Interest

For those big-ticket items, the TJ Maxx Card offers deferred interest on select purchases. This means you can pay off your balance over time without worrying about interest charges, giving you the flexibility to manage your finances more effectively.

Who Should Get the TJ Maxx Card?

While the TJ Maxx Card is a great option for many shoppers, it's not necessarily the right fit for everyone. Here's who might benefit the most from this card:

- Shoppers who frequently visit TJ Maxx, Marshalls, or HomeGoods.

- Those who want to take advantage of exclusive discounts and cashback offers.

- Individuals looking for a no-annual-fee credit card with flexible payment options.

On the flip side, if you're not a regular shopper at these stores or prefer to avoid credit card debt, the TJ Maxx Card might not be the best choice for you. It's all about finding the right card that aligns with your shopping habits and financial goals.

How to Maximize Your TJ Maxx Card

Getting the most out of your TJ Maxx Card is all about strategy. Here are a few tips to help you make the most of your card:

Track Your Spending

Keep an eye on your spending habits by reviewing your statements regularly. This will help you stay within your budget and avoid unnecessary debt.

Take Advantage of Promotions

Stay updated on the latest promotions and discounts offered to cardholders. Sign up for email notifications or follow TJ Maxx on social media to stay in the loop.

Pay Off Your Balance on Time

One of the keys to maximizing your card is paying off your balance in full and on time. This will help you avoid interest charges and maintain a healthy credit score.

Common Questions About the TJ Maxx Card

Here are some frequently asked questions about the TJ Maxx Card:

Is the TJ Maxx Card a Credit Card?

Yes, the TJ Maxx Card is a credit card issued by Synchrony Bank. It can be used at TJ Maxx, Marshalls, and HomeGoods locations, both in-store and online.

Does the TJ Maxx Card Have an Annual Fee?

No, the TJ Maxx Card does not charge an annual fee, making it a budget-friendly option for everyday use.

Can I Use the TJ Maxx Card Elsewhere?

The TJ Maxx Card is primarily designed for use at TJ Maxx, Marshalls, and HomeGoods. However, it can also be used at other retailers that accept Synchrony Bank credit cards.

Conclusion

In conclusion, the TJ Maxx Card is a fantastic option for anyone who loves to shop smart. With its cashback rewards, exclusive discounts, and deferred interest options, it offers a range of benefits that make shopping more rewarding and enjoyable. Whether you're a regular at TJ Maxx or just looking to explore its treasures, this card has something for everyone.

So, why not take the first step towards smarter shopping? Apply for the TJ Maxx Card today and unlock a world of savings and rewards. And don't forget to share your experiences with us in the comments below—we'd love to hear how the card has enhanced your shopping journey!

Table of Contents

- What is the TJ Maxx Card?

- Key Features of the TJ Maxx Card

- How Does the TJ Maxx Card Work?

- Steps to Apply for the TJ Maxx Card

- Benefits of the TJ Maxx Card

- Cashback Rewards

- Exclusive Discounts

- Deferred Interest

- Who Should Get the TJ Maxx Card?

- How to Maximize Your TJ Maxx Card