Let’s face it, folks. Payroll can be a nightmare. Whether you're a business owner or an accountant, managing employee payments, taxes, and deductions can feel like juggling chainsaws in the middle of a hurricane. But guess what? Intuit Paycheck swoops in like a superhero to save the day. This powerful tool isn’t just about cutting checks—it’s about streamlining your payroll process so you can focus on running your business instead of drowning in spreadsheets.

Now, before we dive deep into the world of Intuit Paycheck, let me tell you something. If you’ve ever felt lost in the labyrinth of payroll software, you’re not alone. Small business owners everywhere are searching for solutions that don’t require a degree in rocket science to figure out. That’s where Intuit steps in with its user-friendly approach and robust features. It’s like having a personal assistant for all your payroll needs—except this one doesn’t need coffee breaks.

What makes Intuit Paycheck stand out from the crowd? Well, buckle up because we’re about to break it down for you. This isn’t just another piece of software; it’s a game-changer. So, whether you’re looking to simplify your payroll process or just want to ensure compliance with ever-changing tax laws, this guide is here to walk you through everything you need to know.

Read also:Erie Showtimes Your Ultimate Guide To Unbeatable Entertainment

What Exactly is Intuit Paycheck? Let’s Break It Down

First things first, let’s clear the air. Intuit Paycheck is part of the Intuit family, which also includes QuickBooks and TurboTax. It’s designed specifically for small businesses that need an easy-to-use payroll solution without breaking the bank. Think of it as your go-to tool for managing employee payments, tax filings, and compliance—all wrapped up in one neat package.

Here’s the kicker: it’s not just about automating payroll. Intuit Paycheck also helps you stay on top of federal, state, and local tax requirements. That means fewer headaches and more peace of mind. Plus, it integrates seamlessly with QuickBooks, making it even easier to manage your finances. It’s like peanut butter and jelly—two great things that work even better together.

Why Choose Intuit Paycheck Over Other Payroll Solutions?

Let’s be real, there are plenty of payroll tools out there. But why should you choose Intuit Paycheck over the competition? Here are a few reasons:

- Ease of Use: Intuit Paycheck is designed with simplicity in mind. Even if you’re not a payroll expert, you can get up and running in no time.

- Comprehensive Features: From direct deposit to tax filings, Intuit Paycheck covers all the bases. You won’t need to juggle multiple tools to manage your payroll.

- Reliability: With Intuit’s reputation for accuracy and compliance, you can trust that your payroll is in good hands.

- Cost-Effective: Unlike some of its competitors, Intuit Paycheck offers affordable pricing plans that scale with your business needs.

Key Features of Intuit Paycheck

Now that we’ve established what Intuit Paycheck is, let’s talk about what it can do for you. This software isn’t just a one-trick pony; it’s packed with features that make managing payroll a breeze. Here’s a closer look:

1. Automated Payroll Processing

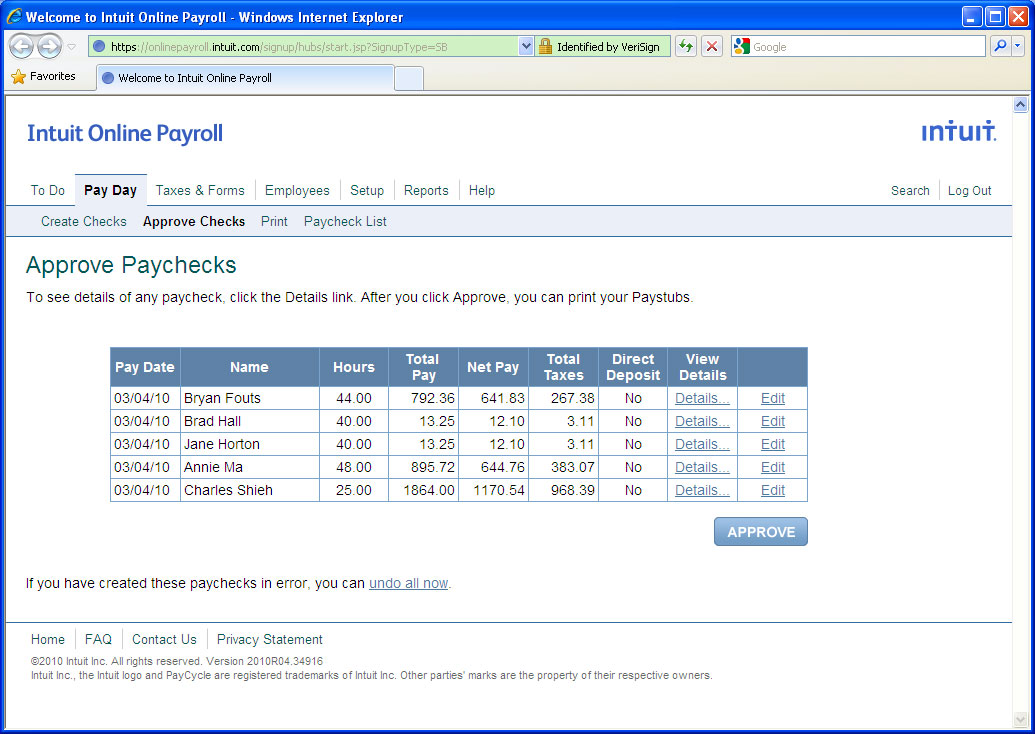

Forget about manual calculations and endless spreadsheets. Intuit Paycheck automates the entire payroll process, ensuring accuracy and saving you tons of time. You can set up recurring pay schedules, and the system will handle the rest. It’s like having a personal assistant who never takes a day off.

2. Direct Deposit

Gone are the days of cutting paper checks. With Intuit Paycheck, you can offer direct deposit to your employees, making it faster and more convenient for everyone involved. Plus, employees can access their pay stubs online, so there’s no need to chase down physical copies.

Read also:Unveiling The Magic Of Rmc Stadium Cinemas At Jacksonville Jacksonville Il

3. Tax Compliance

Taxes are tricky, but Intuit Paycheck makes them a whole lot easier. The software automatically calculates and files federal, state, and local taxes on your behalf. It even keeps you updated on any changes in tax laws, so you’re always in compliance. It’s like having a tax expert on speed dial.

How Intuit Paycheck Benefits Small Businesses

Small businesses often operate on tight budgets and limited resources. That’s why having the right tools in place is crucial. Intuit Paycheck offers several benefits that cater specifically to the needs of small business owners:

1. Scalability

Whether you have two employees or 20, Intuit Paycheck grows with your business. You can add or remove employees as needed without any hassle. It’s like a Swiss Army knife for payroll—always ready to adapt.

2. Cost Savings

Hiring a dedicated payroll specialist can be expensive. With Intuit Paycheck, you get all the benefits of professional payroll management at a fraction of the cost. It’s like getting a luxury car for the price of a bike.

3. Time Efficiency

Time is money, and Intuit Paycheck understands that. By automating repetitive tasks, it frees up your time to focus on growing your business. No more spending hours on payroll when you could be closing deals or brainstorming new ideas.

Intuit Paycheck Pricing Plans: Which One is Right for You?

One of the biggest questions small business owners have is about pricing. Let’s break down the different pricing plans offered by Intuit Paycheck:

1. Essentials

This is the basic plan, perfect for businesses just starting out. It includes features like automated payroll processing, direct deposit, and tax filings. Think of it as the foundation of your payroll system.

2. Enhanced

If you’re looking for more advanced features, the Enhanced plan is the way to go. It includes everything in the Essentials plan, plus additional tools like time tracking and employee self-service. It’s like upgrading from a compact car to an SUV.

3. Premium

For larger businesses with more complex payroll needs, the Premium plan offers the most comprehensive set of features. It includes all the bells and whistles, from unlimited payroll runs to expert support. It’s like driving a luxury sedan with all the extras.

Setting Up Intuit Paycheck: A Step-by-Step Guide

Setting up Intuit Paycheck is easier than you might think. Here’s a step-by-step guide to get you started:

Step 1: Sign Up

Head over to the Intuit Paycheck website and sign up for an account. It’s quick and painless, just like getting a flu shot.

Step 2: Enter Employee Information

Once you’re signed up, it’s time to enter your employee details. This includes names, addresses, and tax information. The system will guide you through the process, so don’t worry if you’re not a payroll expert.

Step 3: Set Up Pay Schedules

Decide how often you want to pay your employees—weekly, bi-weekly, or monthly—and set up your pay schedules accordingly. Intuit Paycheck will take care of the rest.

Common Challenges and How Intuit Paycheck Solves Them

No payroll system is perfect, but Intuit Paycheck comes pretty close. Here are some common challenges businesses face and how Intuit Paycheck addresses them:

1. Complexity

Payroll can be complicated, but Intuit Paycheck simplifies the process with its intuitive interface and step-by-step guidance. It’s like having a GPS for payroll.

2. Compliance Issues

Tax laws are constantly changing, but Intuit Paycheck keeps you updated and ensures compliance. You won’t have to worry about missing a deadline or making a costly mistake.

3. Cost

With affordable pricing plans, Intuit Paycheck offers a cost-effective solution for businesses of all sizes. It’s like getting a five-star meal at a two-star price.

Intuit Paycheck vs. Competitors: A Side-by-Side Comparison

Let’s compare Intuit Paycheck with some of its top competitors:

1. Gusto

Gusto is another popular payroll solution, but it tends to be more expensive than Intuit Paycheck. While it offers similar features, the cost difference can be a dealbreaker for small businesses.

2. Paychex

Paychex is known for its robust features, but it also comes with a hefty price tag. Intuit Paycheck offers comparable functionality at a much lower cost, making it a better choice for budget-conscious businesses.

3. ADP

ADP is a well-established name in the payroll industry, but it can be overwhelming for small businesses. Intuit Paycheck, on the other hand, is designed specifically for small businesses, making it easier to use and more affordable.

Customer Reviews and Success Stories

Don’t just take our word for it. Here are some real-life success stories from Intuit Paycheck users:

- John D., Small Business Owner: “Intuit Paycheck has saved me countless hours and headaches. I can now focus on growing my business instead of stressing about payroll.”

- Sarah M., Accountant: “The tax compliance features are a lifesaver. I no longer have to worry about missing deadlines or making mistakes.”

- Mike R., HR Manager: “Our employees love the direct deposit and online pay stubs. It’s made everyone’s life easier.”

Conclusion: Why Intuit Paycheck is a Must-Have for Small Businesses

In conclusion, Intuit Paycheck is a powerful tool that simplifies payroll management for small businesses. With its user-friendly interface, comprehensive features, and affordable pricing, it’s a no-brainer for anyone looking to streamline their payroll process. So, what are you waiting for? Give Intuit Paycheck a try and see how it can transform your business.

And hey, don’t forget to leave a comment or share this article with your network. Who knows? You might just help someone else solve their payroll woes. Until next time, stay sharp and keep those paychecks rolling!

Table of Contents:

- What Exactly is Intuit Paycheck?

- Why Choose Intuit Paycheck Over Other Payroll Solutions?

- Key Features of Intuit Paycheck

- How Intuit Paycheck Benefits Small Businesses

- Intuit Paycheck Pricing Plans

- Setting Up Intuit Paycheck

- Common Challenges and How Intuit Paycheck Solves Them

- Intuit Paycheck vs. Competitors

- Customer Reviews and Success Stories

- Conclusion