Let’s be real here folks, managing money ain’t easy. We’ve all been there—staring at our bank account wondering where all the cash went. That’s why having a solid budgeting system like You Need A Budget (YNAB) is a game changer. With just a simple YNAB login, you can transform the way you handle your finances. It’s not just an app; it’s a lifeline for anyone serious about taking control of their money.

Picture this: you’re sitting on your couch scrolling through social media, and suddenly you see those flashy ads showing people living their best lives without financial stress. Meanwhile, you’re over here trying to figure out how to pay next month’s rent. The truth is, financial freedom doesn’t come from magic—it comes from discipline, planning, and tools like YNAB that actually work.

YNAB isn’t just another budgeting app. It’s a complete mindset shift. And guess what? All it takes to get started is creating a You Need A Budget login. In this article, we’ll dive deep into why YNAB is so effective, how to set up your account, and how it can help you crush your financial goals. So grab a coffee, sit back, and let’s talk money.

Read also:Example Of Operant Conditioning A Comprehensive Guide To Understanding Behavior Modification

What Exactly Is You Need A Budget?

YNAB stands for You Need A Budget, and it’s more than just a catchy name. It’s a powerful budgeting tool designed to help you break the paycheck-to-paycheck cycle and build lasting financial habits. Unlike other budgeting apps that focus on tracking expenses after the fact, YNAB flips the script by encouraging you to give every dollar a job before you spend it. Sounds revolutionary, right?

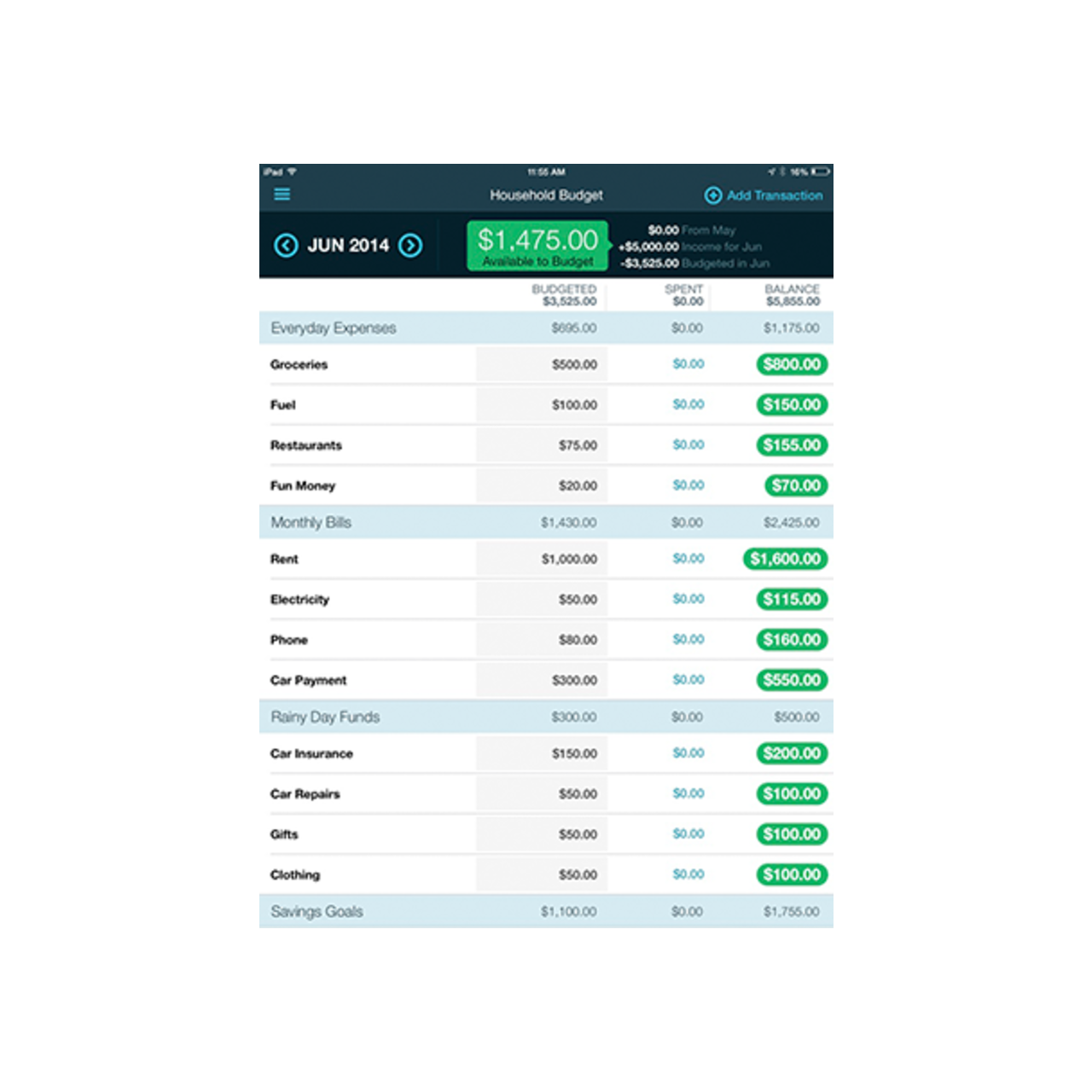

Here’s the deal: YNAB uses the “Zero-Based Budgeting” method, which means every dollar you earn gets assigned a specific purpose. Whether it’s paying bills, saving for emergencies, or treating yourself to that new pair of sneakers, every cent has a plan. This approach helps you stay on top of your spending and ensures you’re always prepared for whatever life throws your way.

How Does YNAB Work?

Once you create your You Need A Budget login, you’ll have access to a user-friendly interface that makes budgeting feel less like a chore and more like a fun challenge. Here’s how it works:

- Connect Your Accounts: Link your bank accounts, credit cards, and loans to YNAB so everything is in one place.

- Create Categories: Break down your expenses into categories like housing, groceries, entertainment, and savings goals.

- Assign Dollars: Allocate your income to each category based on your priorities. Remember, every dollar needs a job!

- Track Your Progress: As you spend money, update your budget to see how you’re doing in real-time.

YNAB also offers features like rollover budgeting, where leftover funds from one month roll into the next, giving you even more flexibility. Plus, it syncs across all your devices, so you can manage your budget anytime, anywhere.

Why You Should Sign Up for a YNAB Login

Now that you know what YNAB is, let’s talk about why you absolutely need to sign up for a You Need A Budget login. Here are some compelling reasons:

Reason #1: Stop Living Paycheck to Paycheck

Do you ever feel like you’re stuck in a never-ending cycle of waiting for your next paycheck just to cover basic expenses? YNAB helps you break free from that cycle by teaching you to live on last month’s income. By planning ahead and saving up, you can create a buffer that keeps you financially stable no matter what happens.

Read also:Unlock Your Future With The Herzing Portal Your Gateway To Academic Excellence

Reason #2: Pay Off Debt Faster

Debt can be a major roadblock to financial freedom. With YNAB, you can prioritize debt repayment by setting aside money specifically for that purpose. The app even lets you track your progress as you chip away at those balances, keeping you motivated and on track.

Reason #3: Save More Money

Whether you’re saving for a vacation, a down payment on a house, or an emergency fund, YNAB makes it easier to reach your savings goals. By allocating funds to specific categories, you ensure that your savings aren’t getting eaten up by unexpected expenses.

How to Create Your You Need A Budget Login

Ready to take the plunge? Setting up your YNAB login is a breeze. Follow these simple steps:

- Head over to the YNAB website and click on the “Start Free Trial” button.

- Enter your email address and create a password. That’s it—you’re now a proud YNAB user!

- Log in to your account and start setting up your budget. Don’t worry if it feels overwhelming at first—YNAB offers tons of tutorials and resources to help you get started.

And here’s the best part: YNAB offers a free 34-day trial, so you can test drive the app before committing. If you love it (spoiler alert: you will), you can subscribe for just $14.99 per month or $84 per year. Totally worth it if you ask me.

Top Features of YNAB That Make It Stand Out

So what makes YNAB different from other budgeting apps out there? Let’s break it down:

- Zero-Based Budgeting: Every dollar gets a job, ensuring nothing slips through the cracks.

- Real-Time Syncing: Your budget updates automatically as you spend, so you’re always in the know.

- Debt Management Tools: Track your progress and stay motivated as you pay off debt.

- Goal Tracking: Set and achieve savings goals with ease.

- Support Resources: Access to a robust community, video lessons, and live support to help you succeed.

These features make YNAB more than just a budgeting app—it’s a comprehensive financial wellness platform.

The Benefits of Using YNAB for Your Finances

Let’s talk benefits, because who doesn’t love a good list? Here are some of the top advantages of using YNAB:

Benefit #1: Improved Financial Awareness

When you use YNAB, you become hyper-aware of where your money is going. This awareness is key to making smarter financial decisions and avoiding unnecessary spending.

Benefit #2: Reduced Stress

Financial stress is real, but YNAB helps alleviate it by giving you a clear plan and peace of mind. Knowing that every dollar has a purpose makes budgeting feel less overwhelming.

Benefit #3: Increased Savings

With YNAB’s goal-oriented approach, you’ll find yourself saving more money than ever before. Whether it’s for short-term goals like buying a new gadget or long-term dreams like retirement, YNAB keeps you focused.

Common Questions About You Need A Budget Login

Still have some questions? Don’t worry—we’ve got you covered. Here are some frequently asked questions about YNAB:

Q: Is YNAB free?

A: YNAB offers a free 34-day trial, after which you’ll need to subscribe. The subscription costs $14.99 per month or $84 per year.

Q: Can I use YNAB on multiple devices?

A: Absolutely! YNAB syncs across all your devices, so you can access your budget from your phone, tablet, or computer.

Q: Does YNAB offer customer support?

A: Yes! YNAB has a dedicated support team ready to assist you with any questions or issues you may encounter.

Case Studies: Real People, Real Results

Don’t just take our word for it—here are some real-life success stories from YNAB users:

Case Study #1: Sarah’s Debt-Free Journey

Sarah was drowning in credit card debt when she discovered YNAB. Within six months of using the app, she paid off $10,000 in debt and built an emergency fund. She credits YNAB’s zero-based budgeting method for helping her stay focused and disciplined.

Case Study #2: John’s Savings Milestone

John used YNAB to save $20,000 for a down payment on his first home. By setting clear goals and sticking to his budget, he achieved his dream faster than he ever thought possible.

Conclusion: Take Control of Your Finances Today

Managing money doesn’t have to be stressful or complicated. With a You Need A Budget login, you can take control of your finances and start building a brighter future. From breaking the paycheck-to-paycheck cycle to paying off debt and saving for your dreams, YNAB has everything you need to succeed.

So what are you waiting for? Sign up for your free trial today and join the thousands of people who have transformed their financial lives with YNAB. And don’t forget to share this article with your friends and family—because good financial habits are contagious!

Table of Contents

- Why You Need a Budget Login to Master Your Finances

- What Exactly Is You Need A Budget?

- How Does YNAB Work?

- Why You Should Sign Up for a YNAB Login

- Reason #1: Stop Living Paycheck to Paycheck

- Reason #2: Pay Off Debt Faster

- Reason #3: Save More Money

- How to Create Your You Need A Budget Login

- Top Features of YNAB That Make It Stand Out

- The Benefits of Using YNAB for Your Finances

- Benefit #1: Improved Financial Awareness

- Benefit #2: Reduced Stress

- Benefit #3: Increased Savings

- Common Questions About You Need A Budget Login

- Case Studies: Real People, Real Results

- Conclusion: Take Control of Your Finances Today