Looking for a reliable platform to secure loans tailored to your needs? Fintechzoom.com loans might just be the answer you’ve been searching for. In today’s fast-paced financial world, finding the right loan option can feel like trying to find a needle in a haystack. But fear not, because Fintechzoom.com is here to simplify your financial journey. Whether you’re a small business owner, a student, or someone looking to consolidate debt, this platform offers innovative solutions designed to fit your unique situation.

In this digital age, traditional banking isn’t always the most convenient option. That’s where fintech platforms like Fintechzoom.com step in. By leveraging cutting-edge technology, they provide streamlined services that make borrowing easier than ever before. But what exactly makes Fintechzoom.com loans stand out from the crowd? Stick around as we dive deep into the world of fintech loans and explore why this platform could be your next big financial move.

Before we get into the nitty-gritty details, it’s important to understand that Fintechzoom.com isn’t just another loan provider; it’s a game-changer in the financial industry. With its user-friendly interface and competitive interest rates, it’s no wonder more and more people are turning to this platform to meet their financial needs. So, whether you’re curious about how it works or want to know if it’s right for you, this guide will cover everything you need to know.

Read also:Vadoc Inmate Locator Your Ultimate Guide To Finding Inmates In Vadoc

What Is Fintechzoom.com Loans All About?

Fintechzoom.com loans are designed to cater to a wide range of borrowers, offering flexibility and convenience that traditional lenders often lack. The platform operates on the principles of innovation, transparency, and customer satisfaction, ensuring that every user has access to the financial tools they need. Here’s a quick rundown of what makes Fintechzoom.com loans so appealing:

- Fast Approval Process: Get approved within minutes, not days.

- Competitive Interest Rates: Enjoy lower rates compared to traditional lenders.

- Flexible Repayment Options: Choose a repayment plan that fits your budget.

- No Hidden Fees: Say goodbye to unexpected charges and complicated terms.

By focusing on these key aspects, Fintechzoom.com aims to revolutionize the way people approach borrowing. It’s not just about getting a loan; it’s about empowering individuals to take control of their financial futures.

How Does Fintechzoom.com Loans Work?

Understanding the mechanics behind Fintechzoom.com loans is crucial if you’re considering applying. Here’s a step-by-step guide to help you navigate the process:

- Application: Start by visiting the official website and filling out an online application form. You’ll need to provide some basic information, such as your income, employment status, and desired loan amount.

- Verification: Once your application is submitted, Fintechzoom.com will verify your information. This usually involves checking your credit score and employment details.

- Approval: If everything checks out, you’ll receive an approval notification. This process can take as little as a few minutes.

- Funding: After approval, the funds will be deposited directly into your bank account, often within 24-48 hours.

As you can see, the process is straightforward and efficient, making it an attractive option for those in need of quick financial solutions.

Why Choose Fintechzoom.com Loans Over Traditional Banks?

When it comes to borrowing money, traditional banks have long been the go-to option for many. However, Fintechzoom.com loans offer several advantages that make them a compelling alternative. Here are a few reasons why you might want to consider this fintech platform:

- Speed: Traditional banks can take weeks to process loan applications, whereas Fintechzoom.com often completes the process in a matter of hours.

- Accessibility: With Fintechzoom.com, you can apply for a loan from the comfort of your own home, anytime and anywhere.

- Transparency: Unlike some banks, Fintechzoom.com is upfront about its terms and conditions, ensuring there are no surprises down the line.

These benefits, among others, highlight why Fintechzoom.com loans are becoming an increasingly popular choice for borrowers worldwide.

Read also:Movies At Chestnut Hill Cinema A Mustvisit Experience For Film Lovers

Types of Loans Available on Fintechzoom.com

Personal Loans

Need cash for unexpected expenses or personal projects? Fintechzoom.com offers personal loans that can be used for virtually any purpose. Whether you’re planning a vacation, renovating your home, or covering medical bills, these loans provide the flexibility you need.

Business Loans

Small business owners often struggle to secure financing from traditional banks. Fintechzoom.com addresses this issue by offering business loans tailored to the unique needs of entrepreneurs. With options ranging from startup capital to expansion funding, this platform has something for every stage of business growth.

Student Loans

Education is an investment in your future, but it can come with a hefty price tag. Fintechzoom.com offers student loans with competitive interest rates and flexible repayment terms, helping students focus on their studies rather than financial stress.

Eligibility Criteria for Fintechzoom.com Loans

Before applying for a loan on Fintechzoom.com, it’s essential to ensure you meet the eligibility criteria. Here’s what you’ll need:

- Be at least 18 years old (or the legal age of majority in your country).

- Have a valid government-issued ID or passport.

- Provide proof of income, such as pay stubs or bank statements.

- Have an active bank account for fund transfers.

Meeting these requirements increases your chances of approval and ensures a smoother application process.

Interest Rates and Fees

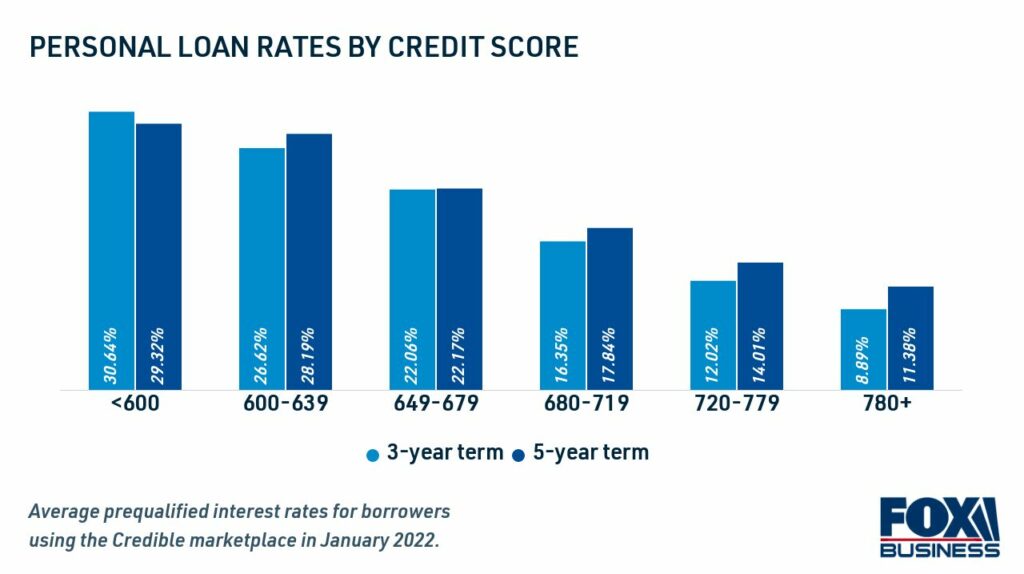

One of the most common concerns when borrowing money is the cost involved. Fintechzoom.com offers competitive interest rates that are typically lower than those of traditional lenders. Additionally, the platform is transparent about its fees, ensuring there are no hidden charges to surprise you later on.

While exact rates may vary depending on factors such as credit score and loan amount, Fintechzoom.com strives to provide fair and affordable options for all borrowers.

Customer Reviews and Testimonials

Word of mouth carries a lot of weight in the financial industry, and Fintechzoom.com has garnered plenty of positive feedback from satisfied customers. Here are a few testimonials that highlight the platform’s strengths:

“I was skeptical at first, but Fintechzoom.com proved me wrong. The application process was seamless, and I received my funds within hours. Highly recommend!” – Sarah M.

“As a small business owner, finding reliable financing can be tough. Fintechzoom.com made it easy and stress-free. Thanks for the support!” – John D.

These reviews underscore the platform’s commitment to delivering exceptional service and value to its users.

Security and Privacy

In the digital age, security and privacy are paramount. Fintechzoom.com takes these concerns seriously, employing state-of-the-art encryption technologies to protect user data. Additionally, the platform adheres to strict regulatory standards, ensuring compliance with global financial regulations.

When you choose Fintechzoom.com, you can rest assured that your personal and financial information is in safe hands.

Common Questions About Fintechzoom.com Loans

How Long Does It Take to Get Approved?

Approval times vary depending on the complexity of your application, but most users receive a decision within minutes.

Are There Any Hidden Fees?

Nope! Fintechzoom.com prides itself on transparency, so you’ll know exactly what you’re signing up for from the start.

Can I Prepay My Loan Without Penalties?

Absolutely! Many of Fintechzoom.com’s loan products allow for early repayment without additional fees, giving you more control over your finances.

Conclusion: Is Fintechzoom.com Loans Right for You?

In conclusion, Fintechzoom.com loans offer a convenient, flexible, and secure way to access the funds you need. Whether you’re a small business owner, a student, or someone looking to consolidate debt, this platform has something to offer everyone. By prioritizing transparency, accessibility, and customer satisfaction, Fintechzoom.com stands out in the crowded fintech landscape.

So, what are you waiting for? Take the first step towards financial freedom by visiting Fintechzoom.com today. Don’t forget to share this article with friends and family who might benefit from this valuable resource. Together, let’s unlock new possibilities and build a brighter financial future!

Table of Contents

- What Is Fintechzoom.com Loans All About?

- How Does Fintechzoom.com Loans Work?

- Why Choose Fintechzoom.com Loans Over Traditional Banks?

- Types of Loans Available on Fintechzoom.com

- Eligibility Criteria for Fintechzoom.com Loans

- Interest Rates and Fees

- Customer Reviews and Testimonials

- Security and Privacy

- Common Questions About Fintechzoom.com Loans

- Conclusion: Is Fintechzoom.com Loans Right for You?