Let’s face it, folks—healthcare costs can hit your wallet harder than a surprise speeding ticket. But if you live in Ontario, the OHIP Income Limits for 2024 might just be the lifeline you didn’t know you needed. Whether you're a student, a parent, or someone trying to make ends meet, understanding these limits is crucial. So, buckle up because we’re about to break it all down in a way that even your grandma could understand.

Now, before we dive headfirst into the nitty-gritty of OHIP income limits, let’s take a moment to appreciate how important this program is. OHIP, or Ontario Health Insurance Plan, is essentially the government’s way of saying, “Hey, we’ve got your back when it comes to medical bills.” But like most things in life, there are rules—and that’s where income limits come in. If you exceed them, you might end up paying more out of pocket, and no one wants that.

And hey, don’t worry if numbers and limits sound like a foreign language to you. This article is here to simplify everything, so by the time you finish reading, you’ll feel like an expert ready to ace any healthcare trivia night. Let’s get started, shall we?

Read also:What Happened To Belle Delphine The Untold Story Behind The Controversy

Understanding OHIP Income Limits 2024

First things first, let’s talk about what OHIP income limits actually mean. Simply put, these limits determine how much money you can earn before you start paying more for your healthcare coverage. Think of it as a budget for your health—cross the line, and things get a little pricier.

In 2024, the income thresholds have been adjusted slightly to keep up with inflation and the rising cost of living. For individuals, the limit sits at around $24,000, while families with two or more dependents can earn up to $48,000 before they hit the cap. Now, these numbers might sound like a lot, but trust me, they can sneak up on you faster than you can say “deductible.”

So, why does this matter? Well, if you exceed these limits, you’ll be looking at additional premiums that can range from a couple of bucks to several hundred dollars a month. And let’s be real, who doesn’t want to keep as much of their paycheck as possible?

How OHIP Income Limits Impact You

Now that we’ve covered the basics, let’s get into the real-world implications. If you’re living paycheck to paycheck, knowing your OHIP income limits is like having a financial crystal ball. It helps you plan ahead and avoid any nasty surprises when tax season rolls around.

For instance, if you’re a single parent juggling multiple jobs, understanding these limits can help you decide whether picking up extra shifts is worth it. Sure, the extra cash might seem tempting, but if it pushes you over the threshold, you could end up paying more in healthcare premiums than you gain in income.

On the flip side, if you’re someone who earns just below the limit, you might want to consider ways to increase your income without crossing that line. Whether it’s through side hustles or investments, every little bit helps when it comes to keeping your healthcare costs in check.

Read also:Unlock Your Potential Dive Into The World Of Talentreef Manager

Key Changes in OHIP Income Limits for 2024

Let’s talk about what’s new in the world of OHIP income limits this year. The government has made some adjustments to ensure the program remains fair and accessible to everyone. One of the biggest changes is the introduction of a sliding scale for premium payments. This means that instead of paying a flat rate once you exceed the limit, your premiums will increase gradually based on how much you earn over the threshold.

For example, if you earn $25,000 as a single individual, you’ll only pay a small percentage of the premium compared to someone earning $30,000. It’s a move that’s been praised for being more equitable, but it also adds a layer of complexity that some people might find confusing.

Another change worth noting is the expansion of coverage for certain groups. Seniors, veterans, and individuals with disabilities now have access to additional benefits that weren’t available before. If you or someone you know falls into one of these categories, it’s definitely worth looking into what’s been added to the program.

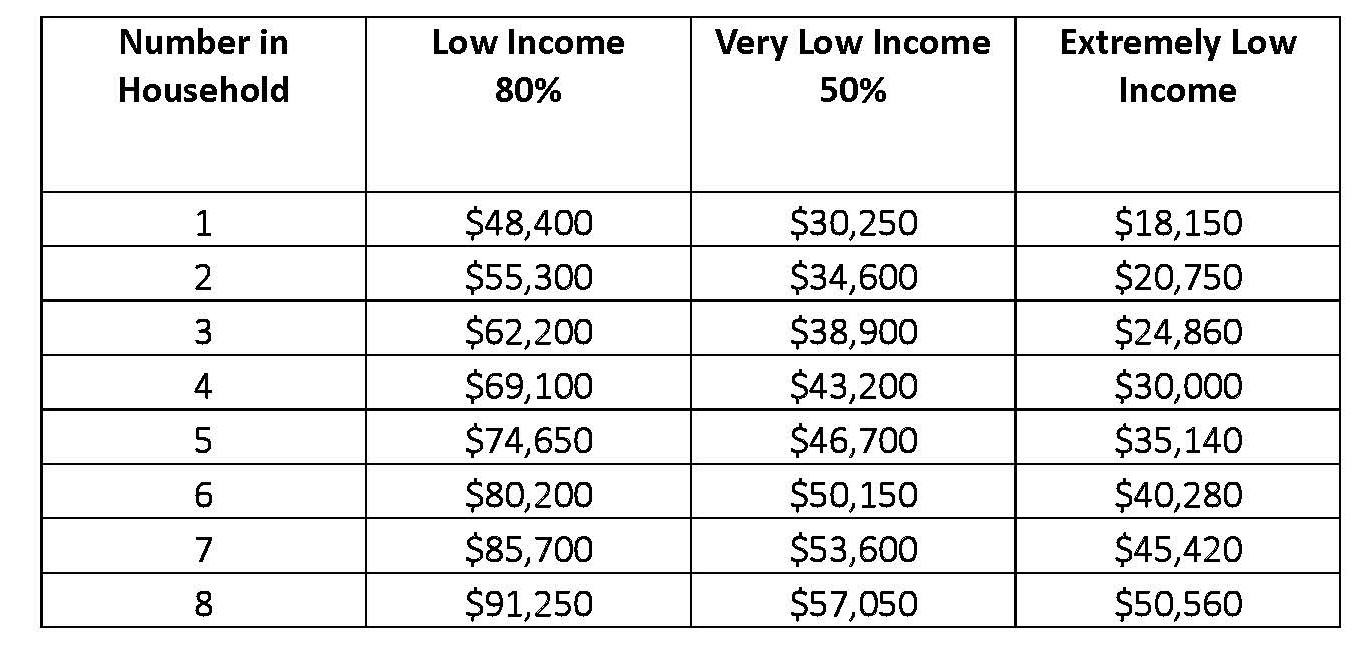

Breaking Down the Numbers

Here’s a quick breakdown of the income limits for 2024:

- Single individuals: $24,000

- Couples without children: $40,000

- Families with one dependent: $44,000

- Families with two or more dependents: $48,000

Remember, these numbers are subject to change, so it’s always a good idea to double-check with the official OHIP website or your local healthcare provider.

Who Does OHIP Income Limits Affect?

Let’s be honest, OHIP income limits don’t just affect one specific group of people—they impact everyone. From students working part-time jobs to retirees living on fixed incomes, understanding these limits is essential for anyone who wants to keep their healthcare costs under control.

But let’s zoom in on a few groups that are particularly affected:

- Young professionals: If you’re just starting out in your career, it’s easy to underestimate how quickly your income can grow. Knowing the limits can help you plan for the future and avoid any unexpected premium hikes.

- Small business owners: Running your own business comes with a lot of financial uncertainties. Having a clear understanding of OHIP income limits can help you budget more effectively and make smarter business decisions.

- Retirees: With fixed incomes and often higher healthcare needs, retirees need to be especially mindful of these limits to ensure they’re getting the most out of their coverage.

And let’s not forget about students. Whether you’re working full-time while studying or trying to make ends meet with a part-time gig, knowing your limits can help you focus more on your education and less on your finances.

Common Misconceptions About OHIP Income Limits

There’s a lot of misinformation floating around out there, so let’s clear up a few common misconceptions about OHIP income limits:

- Misconception #1: “If I earn over the limit, I lose my coverage.” Not true! You’ll still be covered, but you might have to pay higher premiums.

- Misconception #2: “The limits are the same for everyone.” Nope! The limits vary depending on your family size and other factors.

- Misconception #3: “I don’t need to worry about it if I have private insurance.” Wrong again! Even if you have private coverage, knowing your OHIP limits can help you save money in the long run.

So, don’t fall for the hype—stick to the facts and you’ll be golden.

Strategies to Stay Within OHIP Income Limits

Now that we’ve covered the basics, let’s talk about how you can stay within the limits and avoid those pesky premiums. Here are a few strategies to consider:

- Track your income: Keep a close eye on how much you’re earning each month. Use apps or spreadsheets to stay organized and avoid surprises.

- Plan your taxes: Work with a tax professional to ensure you’re maximizing your deductions and credits. Every little bit helps when it comes to staying under the limit.

- Explore other income streams: If you’re close to hitting the limit, consider diversifying your income sources. For example, investing in real estate or starting a side business can help you stay within the threshold while still increasing your overall wealth.

And remember, it’s not just about the money—it’s about finding a balance that works for you and your family.

How to Calculate Your OHIP Premiums

Calculating your OHIP premiums might sound like a headache-inducing task, but it’s actually pretty straightforward. All you need to do is compare your income to the limits and use the sliding scale to determine how much you’ll owe.

Here’s a simple formula to help you get started:

Annual Income - Income Limit = Premium Amount

For example, if you earn $30,000 as a single individual, your calculation would look like this:

$30,000 - $24,000 = $6,000

Based on the sliding scale, you’d then pay a percentage of that $6,000 as your premium. Easy peasy, right?

Using Tools to Simplify the Process

Of course, if math isn’t your strong suit, there are plenty of online tools and calculators that can do the heavy lifting for you. Just plug in your numbers, and voila—you’ll have your premium amount in no time.

Resources for Further Information

If you want to dig deeper into OHIP income limits and how they affect you, here are a few resources to check out:

These sites are packed with useful information and tools to help you make the most of your OHIP coverage.

Conclusion: Taking Control of Your Healthcare Costs

And there you have it, folks—a comprehensive guide to OHIP income limits for 2024. Whether you’re a seasoned pro or a complete newbie, understanding these limits is key to keeping your healthcare costs in check.

So, what’s the takeaway? Know your numbers, plan ahead, and don’t be afraid to ask for help if you need it. And hey, if you found this article helpful, don’t forget to share it with your friends and family. After all, knowledge is power—and when it comes to healthcare, every little bit counts.

Now go forth and conquer those healthcare costs like the rockstar you are!

Table of Contents

- Understanding OHIP Income Limits 2024

- How OHIP Income Limits Impact You

- Key Changes in OHIP Income Limits for 2024

- Breaking Down the Numbers

- Who Does OHIP Income Limits Affect?

- Common Misconceptions About OHIP Income Limits

- Strategies to Stay Within OHIP Income Limits

- How to Calculate Your OHIP Premiums

- Using Tools to Simplify the Process

- Resources for Further Information