Hey there, fellow money-savvy readers! Let's dive right into the world of digital payments and explore one of the most talked-about tools out there – PayPal prepaid card. Whether you're a seasoned traveler, an online shopper, or just someone looking for a safer way to manage your finances, this little gem could be your new best friend. Imagine having a card that lets you access your funds without the hassle of a traditional bank account – sounds pretty cool, right? Well, that's exactly what we're about to break down for you today.

Now, before we get too deep into the nitty-gritty, let's set the stage. A PayPal prepaid card is more than just a piece of plastic; it’s your ticket to simplified money management. It offers flexibility, security, and ease of use, making it a top choice for people who want to avoid credit checks or simply prefer not to link their bank accounts directly to online transactions. Stick around, because this article will be your go-to resource for all things PayPal prepaid!

Before we move on, let me ask you a question – do you ever feel like managing your finances is a bit like playing a game of chess? You're always thinking two steps ahead, trying to outsmart fees, interest rates, and hidden charges. That's where the PayPal prepaid card steps in. It’s like your financial knight in shining armor, ready to protect your hard-earned cash while keeping things simple and straightforward. So, are you ready to level up your money game? Let’s go!

Read also:Ritchay Funeral Home Wisconsin Rapids Your Trusted Companion In Times Of Need

What is a PayPal Prepaid Card?

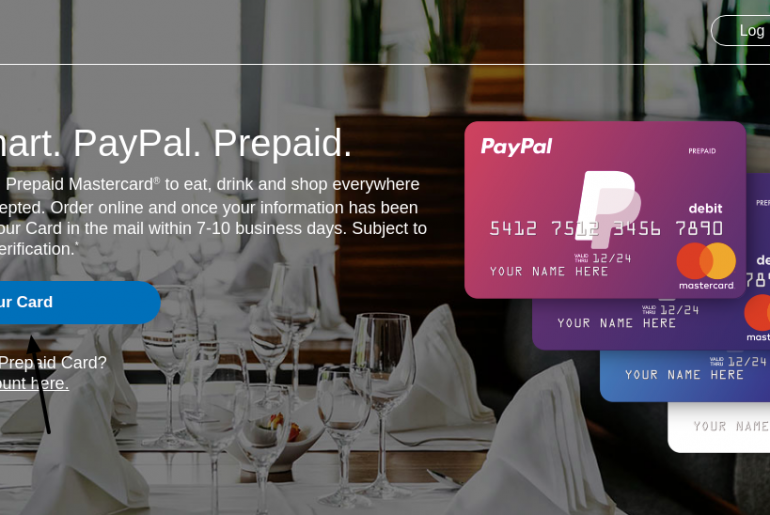

Alright, let’s start with the basics. A PayPal prepaid card is essentially a reloadable card that you can fund directly from your PayPal account. Think of it as a bridge between your digital wallet and the physical world. Unlike traditional debit cards, which are tied to bank accounts, this card operates independently, giving you full control over your spending. It's perfect for those who want to keep things simple, secure, and hassle-free.

One of the coolest features of this card is that it doesn't require a credit check. That means even if you have a less-than-perfect credit history, you can still enjoy the convenience of a card that works almost anywhere Mastercard is accepted. Plus, you can load funds onto the card whenever you need, making it super flexible for managing your budget.

How Does the PayPal Prepaid Card Work?

So, how exactly does this magic card work? Well, it's pretty straightforward. First, you need to sign up for a PayPal account if you don't already have one. Once you're all set up, you can apply for the prepaid card directly through your PayPal account. After approval, you can start loading funds onto the card using your PayPal balance or linked funding sources. Simple, right?

Here’s a quick rundown of the process:

- Sign up for a PayPal account (if you haven’t already).

- Apply for the prepaid card through your account settings.

- Wait for your card to arrive in the mail (usually takes a few days).

- Activate the card online or via the PayPal app.

- Start loading funds and using it wherever Mastercard is accepted.

And just like that, you're ready to rock the world of cashless transactions!

Why Choose a PayPal Prepaid Card?

Now that we’ve covered the basics, let’s talk about why the PayPal prepaid card might be the perfect fit for you. There are plenty of reasons why this card has become such a popular choice among consumers. From enhanced security to budgeting flexibility, it’s packed with features that make managing your money a breeze.

Read also:Plunk Funeral Home A Legacy Of Compassion And Care

For starters, the card offers a layer of protection that traditional debit or credit cards simply can't match. Since it's not directly linked to your bank account, you don't have to worry about unauthorized transactions draining your savings. Plus, if your card ever gets lost or stolen, you can quickly freeze it through the PayPal app, minimizing the risk of fraud.

Key Benefits of Using a PayPal Prepaid Card

Let’s break down some of the key benefits that make the PayPal prepaid card stand out from the crowd:

- Security: Protect your funds by keeping your bank account info private.

- Flexibility: Load funds whenever you need and manage your balance easily.

- No Credit Checks: Enjoy the convenience of a card without worrying about your credit score.

- Global Acceptance: Use your card anywhere Mastercard is accepted, both online and offline.

- Budgeting Tools: Track your spending and stay on top of your finances with ease.

Whether you're a student trying to keep your expenses in check or a professional juggling multiple accounts, the PayPal prepaid card has something for everyone.

Where Can You Use Your PayPal Prepaid Card?

One of the most appealing aspects of the PayPal prepaid card is its versatility. You can use it almost anywhere Mastercard is accepted, which means the possibilities are practically endless. From online shopping to dining out, and even paying bills, this card has got you covered.

Here are just a few examples of where you can put your card to work:

- Online retailers like Amazon, eBay, and countless others.

- Subscription services such as Netflix, Spotify, and gym memberships.

- Travel bookings for flights, hotels, and rental cars.

- Physical stores and restaurants in your local area.

And the best part? You can even use it to withdraw cash from ATMs around the world, giving you access to your funds no matter where you are.

Is the PayPal Prepaid Card Safe to Use?

Security is a top concern for most people when it comes to financial tools, and rightly so. Fortunately, the PayPal prepaid card comes equipped with several features designed to keep your money safe. For starters, it uses the same robust security systems as PayPal itself, which is known for its industry-leading fraud protection.

In addition to that, the card offers zero liability protection, meaning you won’t be held responsible for unauthorized transactions. Plus, you can monitor your account activity in real-time through the PayPal app, making it easy to spot any suspicious activity and take action immediately.

Steps to Enhance Your Card's Security

While the card itself is already pretty secure, there are a few extra steps you can take to boost your protection:

- Set up two-factor authentication for your PayPal account.

- Regularly review your transaction history for any unusual activity.

- Keep your card information private and avoid sharing it online.

- Use strong, unique passwords for your PayPal account.

By following these simple tips, you can enjoy peace of mind knowing your funds are well-protected.

How Much Does a PayPal Prepaid Card Cost?

Cost is always a factor when it comes to financial products, and the PayPal prepaid card is no exception. While the card itself is free to apply for, there are a few fees you should be aware of. These include:

- Card issuance fee (one-time).

- ATM withdrawal fees (varies by location).

- Inactivity fees (if the card isn’t used for an extended period).

However, many of these fees can be avoided by staying active with your card and using it regularly. Plus, PayPal often offers promotions and discounts that can help you save even more.

Who Can Get a PayPal Prepaid Card?

Getting a PayPal prepaid card is relatively straightforward, but there are a few eligibility requirements you need to meet. First and foremost, you must have a verified PayPal account. This typically involves providing proof of identity and linking a funding source, such as a bank account or credit card.

Additionally, you’ll need to be at least 18 years old (or 21 in some states) to apply for the card. Once you meet these criteria, the application process is quick and easy, usually taking just a few minutes to complete.

Steps to Apply for a PayPal Prepaid Card

Ready to get your hands on a PayPal prepaid card? Here’s how you can apply:

- Log in to your PayPal account and navigate to the prepaid card section.

- Complete the application form with your personal details.

- Verify your identity by uploading required documents.

- Wait for approval, which usually happens within minutes.

- Receive your physical card in the mail and activate it online.

And just like that, you’ll be all set to start using your new card!

Alternatives to PayPal Prepaid Card

While the PayPal prepaid card is an excellent option, it’s not the only game in town. There are several other prepaid cards on the market that offer similar features and benefits. Some popular alternatives include:

- Visa prepaid cards.

- Mastercard prepaid cards.

- Green Dot prepaid cards.

Each of these options has its own unique features and fees, so it’s worth doing some research to find the one that best suits your needs.

Tips for Maximizing Your PayPal Prepaid Card

Now that you know all about the PayPal prepaid card, let’s talk about how you can get the most out of it. Here are a few tips to help you make the most of your card:

- Set up automatic reloads to ensure your card is always funded.

- Take advantage of cashback offers and promotions.

- Use the card for recurring payments to simplify your finances.

- Monitor your spending regularly to stay on top of your budget.

By following these tips, you can enjoy the full benefits of your PayPal prepaid card and make the most of its features.

Conclusion

And there you have it, folks – the ultimate guide to the PayPal prepaid card. From its ease of use and security features to its global acceptance and budgeting tools, this card truly has something for everyone. Whether you're looking to simplify your finances, protect your bank account, or just enjoy the convenience of a reloadable card, the PayPal prepaid card is definitely worth considering.

So, what are you waiting for? Head over to your PayPal account and start the application process today. And don’t forget to share your thoughts and experiences in the comments below – we’d love to hear from you! Until next time, stay savvy and keep those finances in check.

Table of Contents

What is a PayPal Prepaid Card?

How Does the PayPal Prepaid Card Work?

Why Choose a PayPal Prepaid Card?

Where Can You Use Your PayPal Prepaid Card?

Is the PayPal Prepaid Card Safe to Use?

How Much Does a PayPal Prepaid Card Cost?

Who Can Get a PayPal Prepaid Card?

Alternatives to PayPal Prepaid Card

Tips for Maximizing Your PayPal Prepaid Card