When it comes to growing your money, Webster Bank CD rates have become a go-to option for savvy investors like you. Imagine earning predictable returns without losing sleep over market fluctuations. CDs, or Certificates of Deposit, are like the reliable friends in your financial world—steady, trustworthy, and packed with potential. Whether you're saving for a dream vacation or building your nest egg, these rates could be your golden ticket.

Now, I know what you're thinking—"Why should I care about Webster Bank CD rates?" Well, let me tell you, my friend, these rates are like the secret sauce in a burger. They might not scream "exciting" at first glance, but they sure deliver when it comes to building wealth over time. With Webster Bank, you're not just dealing with any bank; you're working with a financial powerhouse that's been around for decades, helping people like you make their money work smarter, not harder.

Here's the deal: we'll dive deep into everything you need to know about Webster Bank CD rates. From understanding how they work to uncovering the best strategies for maximizing your returns, this article has got you covered. So grab your favorite drink, sit back, and let's unravel the mystery of Webster Bank's CD offerings together. Trust me, by the end of this, you'll be ready to make some smart moves with your cash.

Read also:Tjx Rewards Unlock Exclusive Perks And Discounts

What Are Webster Bank CD Rates?

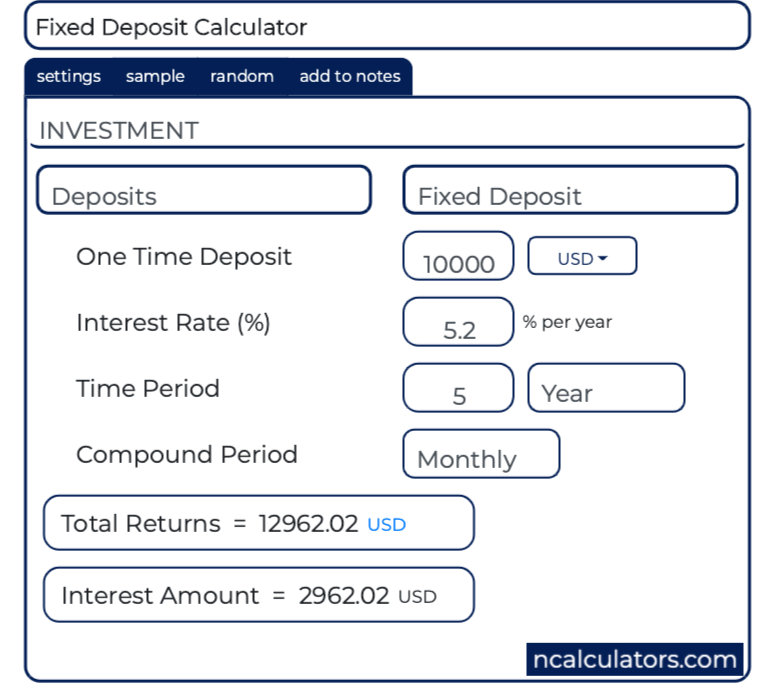

First things first, let's break it down. Webster Bank CD rates refer to the interest rates the bank offers on Certificates of Deposit. Think of CDs as a special kind of savings account where you agree to park your money for a set period—say, 6 months, a year, or even longer. In return, the bank pays you interest at a fixed rate, which is usually higher than what you'd get from a regular savings account.

Why does this matter? Because in today's world, where inflation is eating away at our purchasing power, finding ways to make your money grow is crucial. Webster Bank CD rates provide a predictable way to earn interest without exposing yourself to the wild swings of the stock market. It's like having a safety net for your savings.

Why Choose Webster Bank for Your CDs?

Not all banks are created equal, and Webster Bank stands out for a reason. Established in 1935, this Connecticut-based institution has grown into a major player in the financial world, serving both individuals and businesses. But what makes them special when it comes to CDs?

- Competitive rates that keep up with market trends

- A reputation for stability and reliability

- Flexible terms to suit different investment goals

- Excellent customer service to guide you through the process

Let's face it—when you're trusting a bank with your hard-earned cash, you want to know they've got your back. Webster Bank has been doing just that for generations, and their CD offerings are no exception.

How Do Webster Bank CD Rates Work?

Alright, let's get into the nitty-gritty. When you open a CD with Webster Bank, you're essentially lending them your money for a specific term. During this time, your funds are locked in, meaning you can't touch them without paying a penalty. In return, the bank pays you interest at a fixed rate, which is typically higher than what you'd earn in a standard savings account.

Here's the kicker: the longer the term of your CD, the higher the interest rate you can expect. For example, a 12-month CD might offer a 2% annual percentage yield (APY), while a 5-year CD could give you closer to 3%. It's like a reward for committing your money for a longer period.

Read also:Billy Joel Wiki The Life And Legacy Of The Piano Man

Understanding the Term Lengths

Webster Bank offers a range of CD term lengths to fit different financial goals. Whether you're looking to invest for a short-term goal or planning for the long haul, they've got options that work for you:

- Short-term CDs (3 months to 1 year)

- Intermediate-term CDs (2 to 3 years)

- Long-term CDs (4 to 5 years)

Each term length comes with its own set of pros and cons. Short-term CDs offer more flexibility but usually come with lower rates, while long-term CDs provide higher returns but tie up your money for a longer period. It's all about finding the right balance for your needs.

Current Webster Bank CD Rates

As of the latest update, Webster Bank is offering some pretty attractive CD rates. Keep in mind that these rates can fluctuate based on market conditions and economic factors, so it's always a good idea to check directly with the bank for the most up-to-date information. Here's a snapshot of what you might expect:

- 12-month CD: 1.85% APY

- 24-month CD: 2.10% APY

- 36-month CD: 2.35% APY

- 48-month CD: 2.55% APY

- 60-month CD: 2.75% APY

These rates are competitive compared to other banks, making Webster Bank a solid choice for anyone looking to grow their savings. Plus, with the added benefits of FDIC insurance and a trusted brand, you can rest easy knowing your money is in good hands.

Factors That Influence CD Rates

So, what makes CD rates go up or down? Several factors come into play:

- Federal Reserve policies: When the Fed raises or lowers interest rates, it affects what banks can offer on CDs.

- Market demand: If more people are investing in CDs, banks may adjust rates to stay competitive.

- Economic conditions: Inflation, unemployment, and other economic indicators can impact CD rates.

It's like a big puzzle, and understanding these factors can help you make smarter decisions about when to invest in a CD.

Benefits of Webster Bank CD Rates

Now, let's talk about why Webster Bank CD rates are worth considering. Here are just a few of the perks:

- Guaranteed Returns: Unlike stocks or mutual funds, CDs offer a fixed rate of return, so you know exactly what you'll earn.

- FDIC Insurance: Your money is protected up to $250,000 per depositor, so you don't have to worry about losing it.

- No Market Risk: CDs are unaffected by stock market fluctuations, making them a safer investment option.

- Flexibility: With a variety of term lengths to choose from, you can tailor your investment to match your goals.

These benefits make Webster Bank CD rates an attractive option for anyone looking to grow their savings without taking on too much risk.

Who Should Consider Webster Bank CDs?

Not everyone is a good candidate for CDs, but they're perfect for certain types of investors. Here's who might benefit:

- Conservative investors who prioritize safety over high returns

- Retirees looking for a steady source of income

- Savers with short- to medium-term financial goals

- Anyone seeking a low-maintenance way to grow their money

If any of these descriptions sound like you, Webster Bank CDs could be a great fit. Just remember to consider your overall financial situation before committing your funds.

Comparing Webster Bank CD Rates to Other Banks

When it comes to CD rates, competition is fierce. So how does Webster Bank stack up against other banks? Let's take a look:

While some online banks may offer slightly higher rates, they often come with trade-offs, such as limited branch access or fewer product offerings. Webster Bank, on the other hand, provides a balanced approach with competitive rates, excellent customer service, and a full range of banking services.

Plus, let's not forget the convenience factor. With branches across Connecticut, Massachusetts, and beyond, Webster Bank makes it easy to manage your accounts in person or online. For many people, this combination of value and convenience is hard to beat.

What Makes Webster Bank Stand Out?

Here are a few key differentiators that set Webster Bank apart:

- Strong local presence with a national reputation

- Wide range of financial products and services

- Commitment to customer satisfaction

- Proven track record of stability and reliability

When you choose Webster Bank, you're not just picking a CD—you're partnering with a financial institution that truly cares about your success.

Tips for Maximizing Your CD Investment

Ready to make the most of Webster Bank CD rates? Here are some tips to help you get the best returns:

- Shop Around: Always compare rates from different banks to ensure you're getting the best deal.

- Consider Laddering: This strategy involves spreading your investments across CDs with different maturity dates to maximize liquidity and returns.

- Watch for Special Offers: Some banks offer promotional rates for new customers or specific CD terms, so keep an eye out for these deals.

- Reinvest Wisely: Once your CD matures, decide whether to reinvest in another CD or use the funds for other financial goals.

By following these tips, you can optimize your CD investment and take full advantage of Webster Bank's competitive rates.

Common Mistakes to Avoid

While CDs are generally low-risk investments, there are still pitfalls to watch out for:

- Locking in your money for too long and missing out on higher rates

- Not reading the fine print on terms and penalties

- Ignoring inflation's impact on your returns

Avoiding these mistakes can help ensure your CD investment stays on track and delivers the results you're hoping for.

Conclusion: Take Control of Your Financial Future

There you have it—a comprehensive look at Webster Bank CD rates and why they're worth considering. Whether you're a seasoned investor or just starting out, CDs offer a reliable way to grow your savings without taking on excessive risk. With competitive rates, a trusted brand, and a wide range of options, Webster Bank is a great choice for anyone looking to secure their financial future.

So what are you waiting for? Head over to Webster Bank's website or visit your nearest branch to explore their CD offerings. And don't forget to share this article with friends and family who might benefit from the information. Together, we can all take steps toward a brighter financial future.

Table of Contents

- What Are Webster Bank CD Rates?

- Why Choose Webster Bank for Your CDs?

- How Do Webster Bank CD Rates Work?

- Current Webster Bank CD Rates

- Benefits of Webster Bank CD Rates

- Comparing Webster Bank CD Rates to Other Banks

- Tips for Maximizing Your CD Investment

- Common Mistakes to Avoid

- Conclusion