When it comes to taxes, confusion often reigns supreme. But don’t worry, my friend, because HRBlock Tax Calculator is here to save the day. Whether you’re a first-time filer or just tired of crunching numbers manually, this powerful tool has got your back. Say goodbye to complicated spreadsheets and hello to easy-to-use software that makes tax season a breeze. Trust me, once you dive into the world of HRBlock, you’ll wonder how you ever survived without it.

Taxes can feel like a labyrinth, but with the right tools, you can navigate it effortlessly. HRBlock Tax Calculator isn’t just some random software; it’s a game-changer. Imagine having a personal tax advisor at your fingertips, guiding you through every deduction, credit, and form. That’s exactly what HRBlock offers, and it’s designed to make your life so much easier.

Now, I know what you’re thinking. “Is it really worth it?” Let me tell you, the answer is a resounding YES. With features tailored to simplify even the most complex tax situations, HRBlock Tax Calculator is a must-have for anyone looking to file their taxes accurately and efficiently. So, let’s dive in and explore why this tool is the ultimate solution for your tax filing needs.

Read also:Ritchay Funeral Home Wisconsin Rapids Your Trusted Companion In Times Of Need

Why HRBlock Tax Calculator Stands Out

In the world of tax software, there are plenty of options, but HRBlock Tax Calculator shines for a reason. First and foremost, it’s user-friendly. You don’t need a degree in accounting to figure it out. The interface is intuitive, walking you through each step with clear instructions. Plus, it’s packed with features that cater to both beginners and seasoned tax filers.

One of the standout aspects is its accuracy. With constant updates to reflect the latest tax laws, you can be confident that your return is up-to-date. And let’s not forget the support. HRBlock offers live assistance if you ever get stuck, ensuring you never feel lost in the process. All these elements combined make HRBlock Tax Calculator a top choice for millions of users worldwide.

Key Features You Need to Know

- Federal and state tax filing included

- Step-by-step guidance for every form

- Smart recommendations for deductions and credits

- Real-time error detection to avoid costly mistakes

- 24/7 access to your tax return

These features aren’t just bells and whistles; they’re essential components that make filing your taxes a seamless experience. Whether you’re claiming itemized deductions or taking advantage of the Earned Income Tax Credit, HRBlock Tax Calculator ensures you don’t miss a thing.

How HRBlock Tax Calculator Works

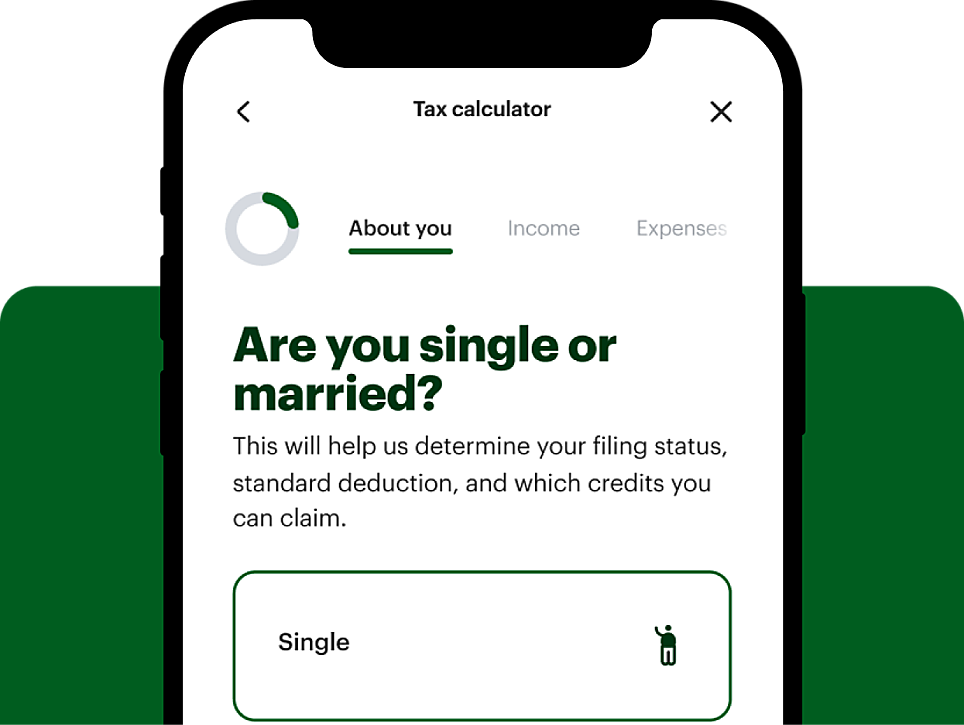

Using HRBlock Tax Calculator is as simple as 1-2-3. First, you input your personal information, like your Social Security number and income details. Then, the software guides you through a series of questions to determine your eligibility for various deductions and credits. Finally, it compiles all the information into a professional tax return ready for submission. It’s that easy!

Step-by-Step Guide to Using HRBlock Tax Calculator

Let’s break it down further:

- Sign up or log in to your HRBlock account

- Enter your income details, including W-2s, 1099s, and any other relevant forms

- Answer the guided questions about deductions, credits, and dependents

- Review your completed tax return for accuracy

- File electronically and receive your refund fast

Each step is designed to be straightforward, ensuring you stay on track without getting overwhelmed. And if you ever need help, the live chat feature is just a click away.

Read also:Nyt Spelling Bee Answers And Analysis Your Ultimate Guide To Mastering The Puzzle

Benefits of Using HRBlock Tax Calculator

The advantages of HRBlock Tax Calculator go beyond just convenience. Here are a few key benefits:

- Time-Saving: No more spending hours poring over tax forms. HRBlock does the heavy lifting for you.

- Cost-Effective: With affordable pricing plans, HRBlock fits any budget. Plus, many plans include both federal and state filing for one price.

- Accuracy: Minimize errors with real-time alerts and expert-verified content.

- Security: Rest assured knowing your sensitive information is protected with advanced encryption technology.

These benefits add up to a stress-free tax filing experience, which is something we can all appreciate.

Common Questions About HRBlock Tax Calculator

Is HRBlock Tax Calculator Free?

While HRBlock offers a free version for simple tax situations, most users opt for the paid plans to access additional features. These plans start at an affordable price and include both federal and state filing in many cases. If you have a straightforward tax return, the free option might work for you. However, for more complex filings, the paid plans are well worth the investment.

Can HRBlock Tax Calculator Handle State Taxes?

Absolutely! HRBlock Tax Calculator covers all 50 states, making it a one-stop solution for your federal and state tax needs. You won’t have to worry about juggling multiple programs or services. Everything is conveniently handled in one place.

What Happens If I Make a Mistake?

Don’t sweat it! HRBlock Tax Calculator is designed to catch errors before you submit your return. If something doesn’t add up, the software will alert you, giving you a chance to correct it. And if you do make a mistake after filing, HRBlock offers amendment services to help you fix it quickly.

Expert Tips for Maximizing Your HRBlock Tax Calculator Experience

Here are a few insider tips to get the most out of HRBlock Tax Calculator:

- Start early to avoid last-minute stress

- Gather all your documents beforehand to streamline the process

- Take advantage of the free audit support offered by HRBlock

- Explore all available deductions and credits to maximize your refund

By following these tips, you’ll not only save time but also ensure you’re getting the best possible outcome from your tax filing.

Comparing HRBlock Tax Calculator to Competitors

While there are other tax software options out there, HRBlock stands out for several reasons. TurboTax, another popular choice, offers similar features, but HRBlock’s pricing is often more competitive. Additionally, HRBlock’s live chat support is available 24/7, whereas TurboTax’s support hours are more limited. When it comes to user experience, HRBlock’s interface is clean and intuitive, making it a favorite among users of all skill levels.

What Sets HRBlock Apart?

Apart from the features mentioned earlier, HRBlock’s commitment to customer service truly sets it apart. Their team is dedicated to helping you succeed, whether it’s answering a quick question or assisting with a complex tax issue. Plus, their extensive network of physical locations means you can always visit an HRBlock office if you prefer face-to-face assistance.

Real User Reviews and Testimonials

Don’t just take my word for it. Here’s what real users have to say about HRBlock Tax Calculator:

“I’ve been using HRBlock for years, and it’s been a lifesaver. The interface is easy to use, and the support team is always there when I need them.” – Sarah L.

“As someone who runs a small business, HRBlock has been invaluable. It helps me keep track of all my expenses and deductions, ensuring I don’t miss a thing.” – John D.

These testimonials highlight the reliability and effectiveness of HRBlock Tax Calculator, proving it’s a trusted choice for individuals and businesses alike.

How HRBlock Tax Calculator Meets YMYL Standards

Since tax filing falls under the YMYL (Your Money or Your Life) category, HRBlock takes its responsibility seriously. Their software is rigorously tested to ensure accuracy and compliance with the latest tax laws. Additionally, their team of tax professionals is constantly updating the software to reflect any changes in regulations. This dedication to quality and accuracy ensures that users can trust HRBlock Tax Calculator to handle their financial information responsibly.

Final Thoughts and Call to Action

In conclusion, HRBlock Tax Calculator is an exceptional tool for anyone looking to simplify their tax filing process. With its user-friendly interface, comprehensive features, and excellent customer support, it’s no wonder so many people rely on HRBlock year after year. Don’t let tax season stress you out any longer. Give HRBlock Tax Calculator a try and experience the difference for yourself.

Now, it’s your turn. Have you used HRBlock Tax Calculator before? What was your experience like? Share your thoughts in the comments below. And if you found this guide helpful, be sure to share it with your friends and family. Together, we can make tax season a little less daunting for everyone.

Table of Contents

- Why HRBlock Tax Calculator Stands Out

- Key Features You Need to Know

- How HRBlock Tax Calculator Works

- Benefits of Using HRBlock Tax Calculator

- Common Questions About HRBlock Tax Calculator

- Expert Tips for Maximizing Your HRBlock Tax Calculator Experience

- Comparing HRBlock Tax Calculator to Competitors

- Real User Reviews and Testimonials

- How HRBlock Tax Calculator Meets YMYL Standards

- Final Thoughts and Call to Action