So listen up, friends. We all know that life can get a little complicated when it comes to managing credit card payments, especially if you're juggling multiple accounts. But today, we're diving deep into the world of JCPenney credit pay bill, and trust me, this is going to be a game-changer. Whether you're a long-time JCPenney cardholder or just starting out, understanding how to navigate your credit payments can save you time, money, and a whole lot of stress. So, grab a cup of coffee, get comfy, and let's break it down together. This is your go-to guide for everything you need to know about JCPenney credit bill payments.

Now, before we dive into the nitty-gritty, let's talk about why this topic matters so much. If you're reading this, chances are you've either used JCPenney's credit card or you're thinking about applying for one. The JCPenney credit card is more than just a piece of plastic; it's a tool that can help you save on your favorite purchases while also building your credit score. But like any tool, you need to know how to use it properly. And that's exactly what we're here for – to make sure you're using your JCPenney credit card to its full potential.

Let's not sugarcoat it. Managing credit card payments can sometimes feel overwhelming. But with the right information and a few simple strategies, you can take control of your finances and make sure you're always on top of your JCPenney credit pay bill. So, whether you're a seasoned pro or a complete newbie, this guide has something for everyone. Let's get started!

Read also:Tj Maxx Card Unlocking Your Shopping Potential

Understanding the Basics of JCPenney Credit Pay Bill

Alright, let's start with the basics. The JCPenney credit card is more than just a way to shop. It's a financial tool that can help you manage your expenses, earn rewards, and even boost your credit score. But to make the most of it, you need to understand how the payment system works. Think of it like learning the rules of a new game – once you know the rules, you can play like a pro.

When it comes to paying your JCPenney credit bill, there are a few key things you need to keep in mind. First, always pay your bill on time. Late payments can not only hit your credit score but also lead to unnecessary fees. Second, try to pay more than the minimum amount due whenever possible. This will help you reduce your overall balance and save on interest charges. And lastly, keep track of your spending so you're never caught off guard by a surprise bill.

Why Managing Your JCPenney Credit Pay Bill Matters

Managing your JCPenney credit pay bill isn't just about avoiding late fees. It's about taking control of your financial future. By paying your bill on time and in full, you're showing lenders that you're responsible and trustworthy. This can lead to better interest rates, higher credit limits, and even access to exclusive promotions and deals. Plus, who doesn't love the feeling of being debt-free?

Setting Up Your JCPenney Credit Pay Bill Online

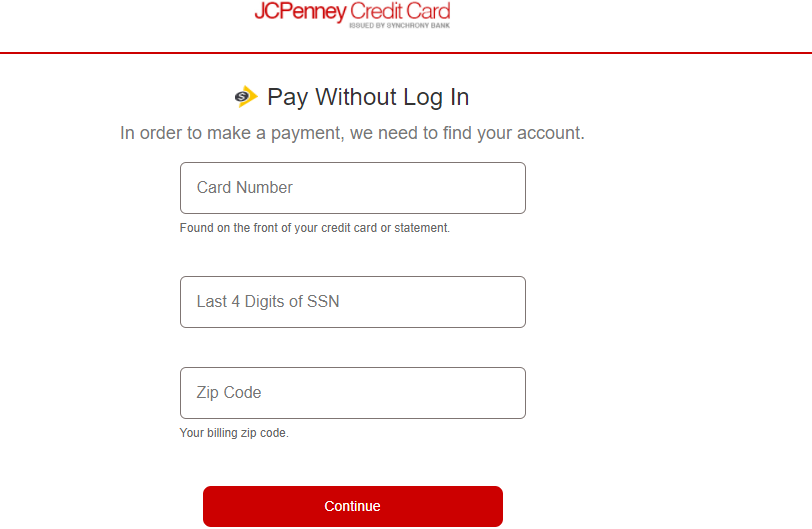

Let's talk about the easiest and most convenient way to manage your JCPenney credit pay bill – online. These days, most people prefer to handle their finances digitally, and JCPenney makes it super easy to do just that. By setting up an online account, you can access your bill anytime, anywhere, and make payments with just a few clicks.

Here's how you can set up your JCPenney credit pay bill online:

- Visit the JCPenney credit card website and click on "Sign In" or "Register."

- Enter your account information, including your card number and personal details.

- Create a strong password and security questions to protect your account.

- Once you're logged in, you can view your current balance, transaction history, and payment options.

Benefits of Managing Your JCPenney Credit Pay Bill Online

Managing your JCPenney credit pay bill online comes with a ton of benefits. For starters, it's super convenient. You can make payments anytime, day or night, without having to worry about missing a deadline. Plus, you can set up automatic payments to ensure you're never late. And let's not forget about the security features – with two-factor authentication and fraud protection, you can rest easy knowing your account is safe.

Read also:My Schedule Kp The Ultimate Guide To Planning Your Dream Trip

Common Questions About JCPenney Credit Pay Bill

Let's tackle some of the most common questions people have about JCPenney credit pay bill. Whether you're wondering about payment deadlines, late fees, or rewards programs, we've got you covered.

How Do I Check My JCPenney Credit Pay Bill?

Checking your JCPenney credit pay bill is easier than ever. Simply log in to your online account and you'll see all the details you need – your current balance, minimum payment due, and payment due date. You can also view your transaction history and payment history to keep track of your spending.

What Happens If I Miss a Payment?

Missing a payment can have serious consequences. Not only will you be hit with a late fee, but it can also negatively impact your credit score. That's why it's so important to set up automatic payments or reminders to ensure you never miss a deadline. And if you do miss a payment, don't panic – contact JCPenney customer service right away to see if they can waive the fee or set up a payment plan.

Strategies for Paying Off Your JCPenney Credit Pay Bill

Paying off your JCPenney credit pay bill doesn't have to be a daunting task. With the right strategies, you can tackle your balance and take control of your finances. Here are a few tips to help you pay off your bill faster:

- Pay more than the minimum amount due each month.

- Take advantage of balance transfer offers to consolidate your debt.

- Use cashback rewards to make extra payments on your bill.

- Set up automatic payments to avoid late fees and missed deadlines.

Should I Pay My JCPenney Credit Pay Bill in Full?

Yes, absolutely. Paying your JCPenney credit pay bill in full is one of the best things you can do for your financial health. Not only does it save you money on interest charges, but it also helps you build a strong credit score. Plus, it gives you peace of mind knowing that you're debt-free and ready to tackle whatever comes next.

Maximizing Your JCPenney Credit Card Rewards

Let's talk about one of the best parts of having a JCPenney credit card – the rewards! Whether you're earning points, cashback, or exclusive discounts, there are plenty of ways to make the most of your card. But to really maximize your rewards, you need to know the tricks of the trade.

How Do JCPenney Credit Card Rewards Work?

JCPenney credit card rewards are pretty straightforward. You earn points for every dollar you spend, and those points can be redeemed for discounts on future purchases. Some cards even offer bonus points for spending in specific categories or during certain promotions. Plus, you can use your rewards to pay down your balance, which is a win-win situation.

Tips for Managing Multiple JCPenney Credit Pay Bills

If you're juggling multiple JCPenney credit pay bills, don't worry – you're not alone. Many people have more than one credit card, and managing them all can be a challenge. But with a little organization and strategy, you can keep everything under control.

Organizing Your JCPenney Credit Pay Bills

Here are a few tips for organizing your JCPenney credit pay bills:

- Use a spreadsheet or budgeting app to track all your accounts and payment due dates.

- Set up automatic payments for each card to ensure you're never late.

- Pay off the card with the highest interest rate first to save money on interest charges.

Customer Support for JCPenney Credit Pay Bill

Sometimes, despite our best efforts, we run into issues with our JCPenney credit pay bill. That's where customer support comes in. JCPenney has a dedicated team ready to help you with any questions or concerns you may have.

How to Contact JCPenney Credit Card Customer Service

Here's how you can reach out to JCPenney credit card customer service:

- Call the toll-free number on the back of your card.

- Send a secure message through your online account.

- Visit a JCPenney store and speak to a customer service representative in person.

The Future of JCPenney Credit Pay Bill

As technology continues to evolve, so does the way we manage our finances. JCPenney is constantly innovating to make it easier for customers to manage their credit pay bill. From mobile apps to voice-activated assistants, the future of credit card management is looking bright.

What's Next for JCPenney Credit Card Users?

Stay tuned for new features and tools that will help you manage your JCPenney credit pay bill more efficiently. Whether it's real-time spending alerts or personalized budgeting advice, JCPenney is committed to helping you achieve your financial goals.

Conclusion: Take Control of Your JCPenney Credit Pay Bill

And there you have it, folks. Everything you need to know about managing your JCPenney credit pay bill. From setting up your online account to maximizing your rewards, this guide has given you all the tools you need to take control of your finances. Remember, paying your bill on time and in full is the key to financial success, so don't let those deadlines slip by.

Now it's your turn. Leave a comment below and let us know how you manage your JCPenney credit pay bill. Or share this article with a friend who could benefit from these tips. And if you're looking for more financial advice, be sure to check out our other articles on personal finance and credit management. Thanks for reading, and happy shopping!

Table of Contents

- Understanding the Basics of JCPenney Credit Pay Bill

- Setting Up Your JCPenney Credit Pay Bill Online

- Common Questions About JCPenney Credit Pay Bill

- Strategies for Paying Off Your JCPenney Credit Pay Bill

- Maximizing Your JCPenney Credit Card Rewards

- Tips for Managing Multiple JCPenney Credit Pay Bills

- Customer Support for JCPenney Credit Pay Bill

- The Future of JCPenney Credit Pay Bill